Change in PD Billing Methodology

Effective July 1, 2022, the PD Purchasing Surcharge will be collected as a percent-to-total of each state department’s prior three-year average billable spend applied to PD’s costs to recover, minus other revenue collected from PD’s remaining rate structures, as found in the DGS Price Book. PD will calculate each state department's annual fee and send equally distributed quarterly invoices to a single DGS Bill Code, or Customer Account Number (CAN).

The current billing methodology for the Purchasing Surcharge is transactional billing, in which a percentage for each transaction is charged to each CAN. The billing data is sourced from the State Contracting and Procurement Registration System (SCPRS); SCPRS entries are automatically generated for state departments transacting in the Financial Information System for California (FI$Cal) while state departments that are not transacting in FI$Cal either manually create their SCPRS entries or utilize an upload process. PD utilizes FI$Cal programming to run and collect its billing in the Project Costing module of FI$Cal. To increase the efficiency of the overall billing process, PD is simplifying and moving its billing process to the Purchasing module of FI$Cal.

The new billing methodology for the Purchasing Surcharge rate will no longer assess a percentage to each billable transaction. Instead, each state department will be charged an annual fee based on a three-year average (PY, PPY, and PPPY) billable spend percent-to-total. Each state department’s percentage will be applied to PD’s cost to recover, minus other revenue collected from PD’s remaining rate structures, as found in the DGS Price Book, and divided into quarterly installments.

The quarterly invoices will be charged to a single CAN that will be used for PD billing purposes. A backup document in spreadsheet format will accompany the invoices and detail the transactions encompassing the state department’s charges. The purpose of this spreadsheet is to aid state departments with internally disseminating these charges. Therefore, it is crucial that state departments continue to select the appropriate CAN as utilized in the past when Creating purchase orders or SCPRS entries; not the designated CAN for PD billing. State departments are responsible for reviewing and downloading this spreadsheet within the fiscal year received since prior year transaction detail will not be stored in FI$Cal.

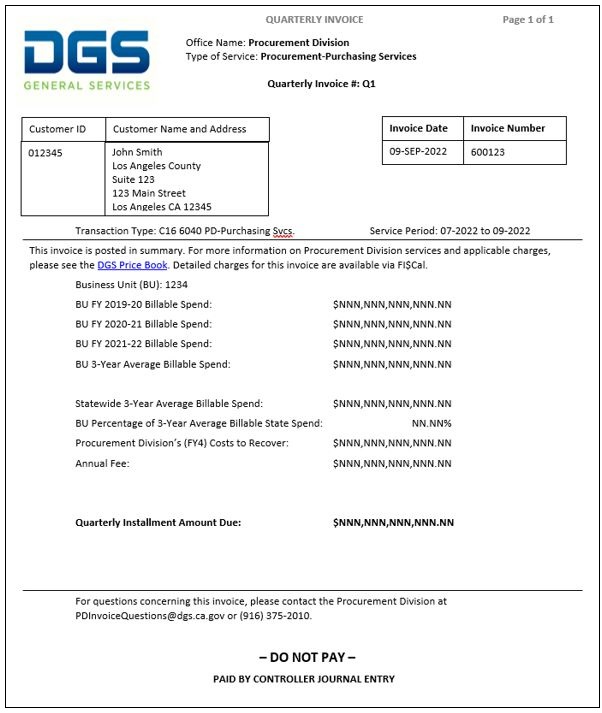

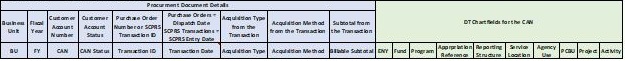

These documents are subject to change, but will resemble the following:

- Please note, this document will not be a useful tool to distribute charges internally if purchase orders are created solely utilizing the designated CAN for PD billing.

- Please note, currently the DT Chartfield data is only available to FI$Cal departments.

- Invoice:

Starting September 2022, the invoices will be displayed in the FI$Cal Customer Portal.

Accessing FI$Cal InterUnit Invoice Portal and Dept. PD Billing Pages

- Read FI$Cal Job Aid FISCal.520 – InterUnit Invoice Portal

The job aid provides both billed and billing state departments with instructions on how to access, review and print invoices in the FI$Cal InterUnit Invoice Portal and how the billing departments must modify their customers' setup to use this portal. - Read Part 3 of the FI$Cal Job Aid – Billing Departments Customer Setup for InterUnit Invoice Portal

All FI$Cal billing departments must first modify their state department customers' setup to meet the requirements for the invoice portal. - Follow the steps to have a DAD request the Interunit Billed Processor role

The Departmental Authority or Designee (DAD) must request the new Interunit Billed Processor and/or Interunit Billing Processor roles for this process for the appropriate staff. Once the roles are setup staff will obtain access to both the FI$Cal Interunit Invoice Portal and DGS' Dept. PD Billing Pages.

- Backup Spreadsheet:

Department users with access to the FI$Cal Customer Portal will be able to review PD Billing and details on two pages. A detailed review and downloadable spreadsheet will be available to assist departments with internally disseminating the billable charges through the following page and tabs:

Main Menu > FI$Cal Processes > FI$Cal Extension > PO > PD Billing > DGS PD Billing

Click on the Dept. PD Billing Review tab to review the overall DGS/PD Billing information:

Click on the Dept. PD Billing Details tab to review the detailed DGS/PD Billing information:

Q. Should we expect to see a larger bill with the new rate methodology?

A. No. PD has implemented this new rate methodology to resolve the ongoing issue of over-collecting revenue.

Q. Is PD going to bill for purchases that are currently not being billed?

A. No. PD is not changing its billing rules for determining which POs are billable. PD is only changing the rate at which those POs are being charged.

Q. Are we supposed to utilize the designated CAN for PD billing on all purchase orders or SCPRS entries?

A. State departments should continue to create purchase orders or SCPRS entries in the exact same manner they do today. This will ensure that the backup spreadsheet will be a useful tool for state departments to distribute the PD billing charges amongst the various CANs in a proportionate and equitable manner. NOTE: Some state departments may have designated a CAN for PD billing that will be utilized on some purchase orders or SCPRS entries, but it should not be used for all of them.

Q. What months will the new quarterly billings process?

A. PD billing will change from invoicing monthly in arrears to quarterly in advance. The new quarterly billings will be invoiced as follows:

Quarter 1:

a. First week of August (If the new budget is loaded before August 1st), or

b. First week of September (If the new budget is loaded after August 1st)

Quarter 2: First week of October

Quarter 3: First week of January

Quarter 4: First week of April

Q. How often will the average be calculated?

A. The average will be calculated every year, utilizing the PY, PPY, and PPPY. For example, FY 2022/23 billing will utilize FYs 2019/20, 2020/21 and 2021/22. Then, FY 2023/24 billing will utilize FYs 2020/21, 2021/22 and 2022/23.

Q. If a credit occurs, will departments get credited?

A. Departments will not receive separate credits on a flow basis. Any changes to POs that adjust the billable subtotal will be incorporated into the following years’ calculations.

Q. What would be considered exempt from DGS PD Billing?

A. Any entity or program through legislative statute exempting them from PD’s authority and oversight.

Contact

please contact PD billing staff at

Phone: (916) 375-2010

email: PDInvoiceQuestions@dgs.ca.gov